Refinancing

Check out our tips, articles, and insights dedicated to empowering everyone to get a great deal on their mortgage.

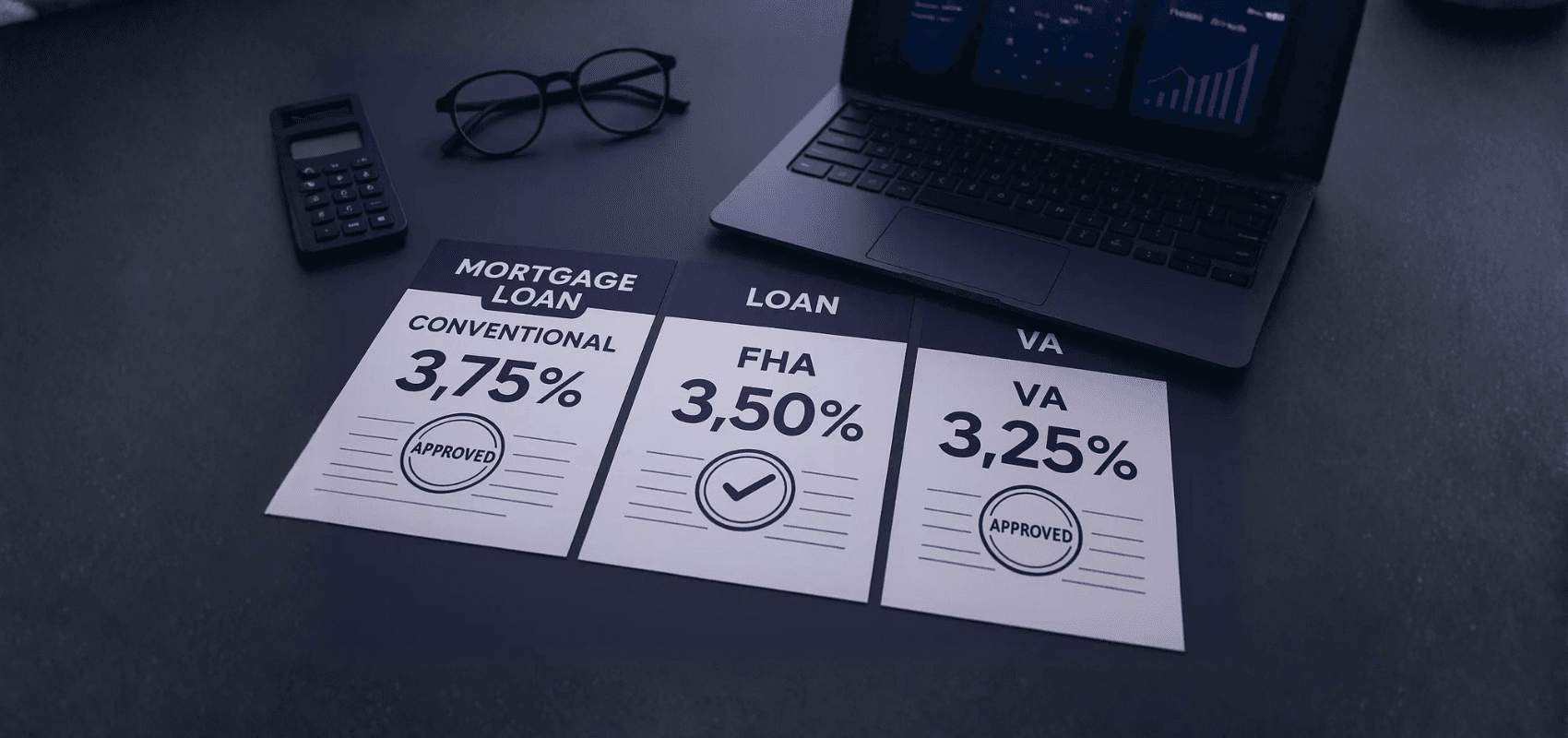

Maximum DTI Limits by Loan Type (FHA, VA, Conventional)

Written by

Benjamin Schieken

Jan 20, 2026

Can You Refinance with a 50% DTI Ratio?

Written by

Benjamin Schieken

Jan 20, 2026

Refinancing vs. HELOC: Which Is Better?

Written by

Benjamin Schieken

Jan 20, 2026

FHA Refinance vs. Conventional Refinance: Which Is Better?

Written by

Benjamin Schieken

Jan 20, 2026

What is an IRRRL?

Written by

Benjamin Schieken

Jan 27, 2026

2026 Refinance Guide: Stay with FHA or Switch to Conventional?

Written by

Benjamin Schieken

Jan 20, 2026

How to Calculate Your DTI for Refinancing

Written by

Benjamin Schieken

Jan 20, 2026

Can You Refinance with a 43% DTI? Conventional Limits

Written by

Benjamin Schieken

Jan 20, 2026

Can You Refinance with a 45% DTI? Requirements

Written by

Benjamin Schieken

Jan 20, 2026

How to Lower Your DTI Before Refinancing (6 Strategies)

Written by

Benjamin Schieken

Jan 20, 2026

What DTI Do You Need to Refinance?

Written by

Benjamin Schieken

Jan 20, 2026

40% DTI and Want to Refinance? Here's What you Must Know

Written by

Benjamin Schieken

Jan 20, 2026

VA Cash-Out Refinance: Requirements & Limits

Written by

Benjamin Schieken

Jan 20, 2026

Understanding Your Break-Even Point: When Does Refinancing Pay Off

Written by

Benjamin Schieken

Jan 20, 2026

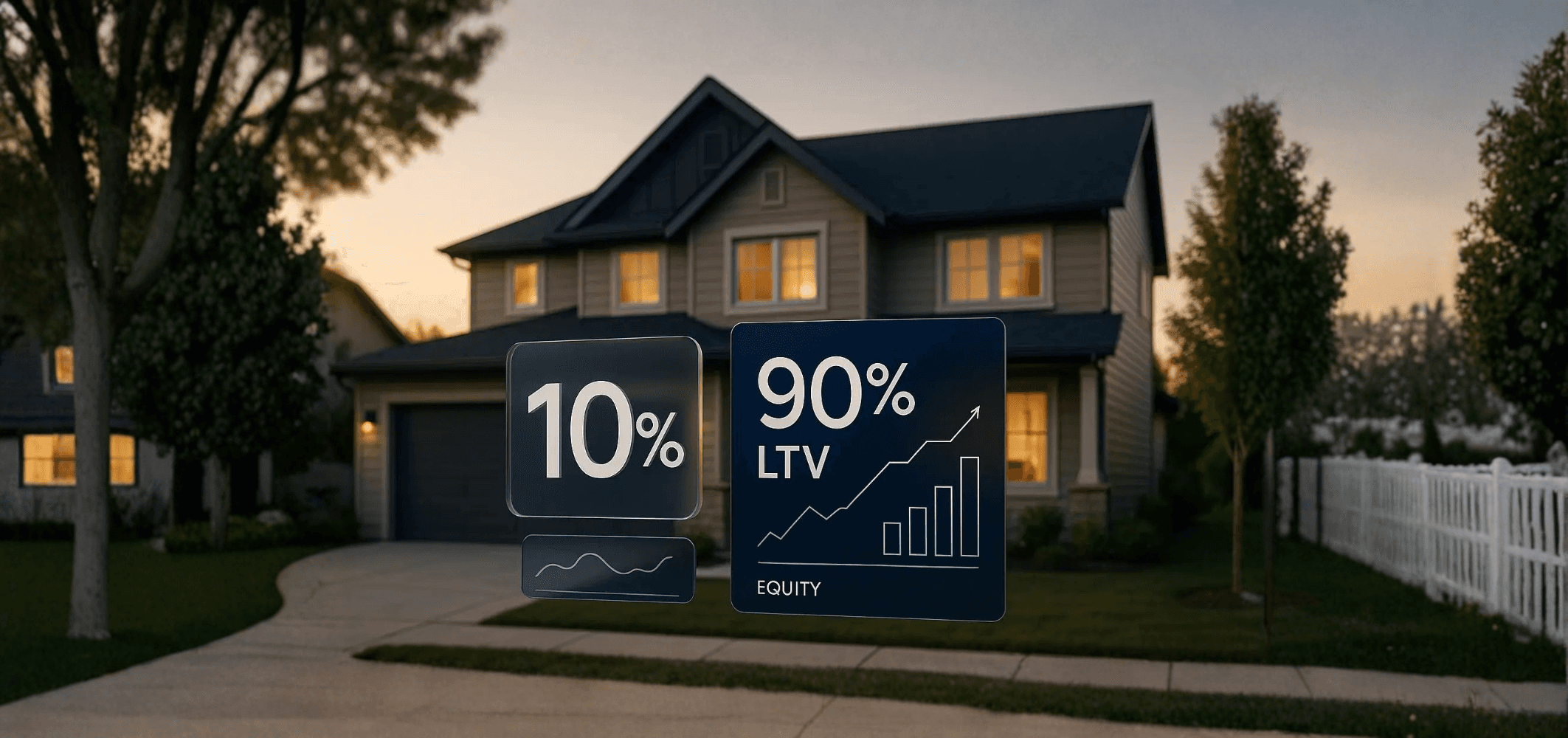

What Is Loan-to-Value (LTV) Ratio? Refinancing Impact

Written by

Benjamin Schieken

Jan 20, 2026

Types of Mortgage Refinancing: Rate-Term, Cash-Out, Streamline

Written by

Benjamin Schieken

Jan 20, 2026

Should I Refinance Now or Wait? The Complete Decision Guide

Written by

Benjamin Schieken

Jan 20, 2026

Is a 1% Rate Drop Worth Refinancing? Real Savings Analysis

Written by

Benjamin Schieken

Jan 20, 2026

Cash-Out Refinance: Complete Guide & Requirements

Written by

Benjamin Schieken

Jan 20, 2026

Traditional Refinance vs. Streamline Refinance: Key Differences

Written by

Benjamin Schieken

Jan 21, 2026

Can I Refinance with 10% Equity? Requirements & Options

Written by

Benjamin Schieken

Jan 21, 2026

What Is an FHA Loan? Refinancing FHA Mortgages Explained

Written by

Benjamin Schieken

Jan 20, 2026

Mortgage Refinancing Made Simple: Step-by-Step Guide for Homeowners

Written by

Benjamin Schieken

Jan 20, 2026

Pros and Cons of Refinancing Your Home: Is It Worth It?

Written by

Benjamin Schieken

Jan 20, 2026

Should I Refinance from 6.5% to 6%? Break-Even Analysis

Written by

Benjamin Schieken

Jan 20, 2026

How to Calculate Your Refinancing Break-Even Point

Written by

Benjamin Schieken

Jan 20, 2026

How Much Equity Do I Need to Refinance My Mortgage?

Written by

Benjamin Schieken

Jan 20, 2026

How Long Does It Take to Refinance a Mortgage? Complete Timeline

Written by

Benjamin Schieken

Jan 20, 2026

What Is a No-Closing-Cost Refinance?

Written by

Benjamin Schieken

Jan 20, 2026

What Is Rate-and-Term Refinancing?

Written by

Benjamin Schieken

Jan 20, 2026

Can I Refinance with Only 5% Equity? What You Should Know

Written by

Benjamin Schieken

Jan 22, 2026

Can I Refinance with 20% Equity? Remove PMI & Save

Written by

Benjamin Schieken

Jan 28, 2026

Can I Refinance with a 580 Credit Score? Options & Alternatives

Written by

Benjamin Schieken

Jan 28, 2026

Can I Refinance with a 650 Credit Score? Rates & Requirements

Written by

Benjamin Schieken

Jan 28, 2026

Can I Refinance with a 680 Credit Score? Best Loan Options

Written by

Benjamin Schieken

Jan 28, 2026

What Is a VA Loan? VA Refinancing Options Explained

Written by

Benjamin Schieken

Jan 27, 2026

What Is a Streamline Refinance? (FHA, VA, USDA)

Written by

Benjamin Schieken

Jan 20, 2026

How to Refinance a VA Loan: IRRRL Complete Guide

Written by

Benjamin Schieken

Jan 20, 2026

FHA Streamline Refinance: Requirements & Benefits

Written by

Benjamin Schieken

Jan 20, 2026

What Is Debt-to-Income (DTI) Ratio? Refinancing Requirements

Written by

Benjamin Schieken

Jan 20, 2026

Current Refinance Rates 2025: What You Need to Qualify

Written by

Benjamin Schieken

Jan 20, 2026

Should I Refinance from 8% to 7%? Calculate Your Savings

Written by

Benjamin Schieken

Jan 20, 2026

What Is Home Equity? How It Impacts Your Ability to Refinance

Written by

Benjamin Schieken

Jan 21, 2026

Is Refinancing Worth It? 7% to 6.5% Rate Drop Analysi

Written by

Benjamin Schieken

Jan 20, 2026

Is Refinancing Worth It? Break-Even Analysis for Homeowners

Written by

Benjamin Schieken

Jan 20, 2026

How Credit Scores Affect Refinancing: What You Need to Know

Written by

Benjamin Schieken

Jan 20, 2026

Can You Refinance with Negative Equity in 2026?

Written by

Benjamin Schieken

Jan 28, 2026

Can I Refinance with a 700 Credit Score? Rates You Can Expect

Written by

Benjamin Schieken

Jan 28, 2026

When Should You Refinance Your Mortgage? (Best Timing Guide 2026)

Written by

Benjamin Schieken

Jan 12, 2026

Home Improvements With the Best ROI

Written by

Benjamin Schieken

Jan 20, 2026

Is a 0.5% Rate Drop Worth Refinancing? Complete Analysis

Written by

Benjamin Schieken

Jan 20, 2026

Is Refinancing Right for You? When to Refinance and When Not To

Written by

Benjamin Schieken

Jan 20, 2026

What Is Cash-Out Refinancing? How It Works

Written by

Benjamin Schieken

Jan 20, 2026

What Is a Cash-In Refinance? When to Bring Money to Closing

Written by

Benjamin Schieken

Jan 20, 2026

Rate-and-Term Refinance vs. Cash-Out Refinance

Written by

Benjamin Schieken

Jan 20, 2026

What Credit Score Do You Need to Refinance in 2026?

Written by

Benjamin Schieken

Jan 28, 2026

How to Build Equity Fast Before Refinancing

Written by

Benjamin Schieken

Jan 28, 2026

Can I Refinance with a 620 Credit Score? FHA & Conventional Options

Written by

Benjamin Schieken

Jan 28, 2026

Cash-Out Refinance to Buy Another Property

Written by

Benjamin Schieken

Jan 20, 2026

How to Refinance a Conventional Loan: Step-by-Step

Written by

Benjamin Schieken

Jan 27, 2026

How to Refinance an FHA Loan to Conventional (Remove PMI)

Written by

Benjamin Schieken

Jan 20, 2026

Mortgage Refinancing Guide 2026: Everything You Need to Know

Written by

Benjamin Schieken

Jan 20, 2026

Selling Your Home: How to Prepare Years in Advance

Written by

Benjamin Schieken

Jan 20, 2026

Mortgage Refinancing Explained: A Complete Guide for Beginners

Written by

Benjamin Schieken

Jan 20, 2026

What to Expect on Refinancing Closing Day: Checklist & Timeline

Written by

Benjamin Schieken

Jan 20, 2026

What Is APR in Refinancing? (vs. Interest Rate & True Cost)

Written by

Benjamin Schieken

Jan 20, 2026

Should I Refinance from 7% to 6%? Break-Even Calculator

Written by

Benjamin Schieken

Jan 20, 2026

Is Refinancing Worth It? 6% to 5.5% Rate Drop Analysi

Written by

Benjamin Schieken

Jan 20, 2026

How to Get the Lowest Refinance Rate in 2026: Expert Tips

Written by

Benjamin Schieken

Jan 20, 2026

Can I Refinance with 15% Equity in My Home?

Written by

Benjamin Schieken

Jan 21, 2026

How Much Equity Do I Need for a Cash-Out Refinance?

Written by

Benjamin Schieken

Jan 28, 2026

What Is a USDA Loan? USDA Refinancing Explained

Written by

Benjamin Schieken

Jan 20, 2026

10 Reasons to Refinance Your Mortgage (And Why You Should)

Written by

Benjamin Schieken

Jan 20, 2026

The Refinancing Process: Step-by-Step from Application to Closing

Written by

Benjamin Schieken

Jan 20, 2026

NEWSLETTER

The Fincast Brief

Sign up for our weekly newsletter for tips to make homeownership more affordable and enjoyable — trusted by thousands of Americans.